Myths & Challenges

Challenges of energy storage

Analyzing the financial study of energy storage is an enormous task and contains significant risk. Solar panels have been demonstrated to perform reliably for decades and operate relatively simply with a one-directional flow of energy.

However energy storage has several deeper layers of operation that may be overcomplicated. Batteries remain electrochemical devices with bidirectional power flow, and a very different set of benefits and more complex off-takers. Also do not forget the shocking 75% failure rate in one public trial in Australia.

The purpose of this section is to demonstrate some of the tricks and pitfalls of energy storage financial analyses.

A quick definition of terms:

- Cyclelife – a cycle is a charge and discharge of a battery to a certain level known as the DOD.

- Degradation – the process by which usable capacity of a battery is permanently lost.

- DOD – depth of discharge, or the level to which a battery is discharged.

- EV – electric vehicle

- LFP (or LiFePO4) – a popular type of chemistry known as Lithium Phosphate or Lithium Iron Phosphate.

- Li-ion – this is a broad class of batteries that contain lithium which includes LFP, NCA, and several other types of chemistry.

- NCA – Nickel-cobalt-aluminum battery, a type of Li-ion battery that is very energy dense and flammable.

Myths of battery energy storage

MYTH #1 - Cyclelife does not equal lifetime

Battery cycles do not equal lifetime. A battery with a claim 8000 cycles does not equal a lifetime of 8000/365 = 22 years.

Unfortunately, lithium batteries are highly reactive chemical tanks that have calendar aging alongside cyclic aging. This means that a battery from the date of manufacture has a limited lifetime. Calendar aging limits the useful lifetime of most LFP and NCA batteries long before their cycle limits will be reached.

MYTH #2 - Inflated Performance

There is unfortunately a lot of battery pack manufacturers who will liberally claim design lifetime and several thousands of cycles of battery use far exceeding the original cell manufacturer specifications.

There is no method of extending battery pack cycles past the cell specifications. There is also no way that two LFP batteries from different manufacturers will have a large difference in cycle-life or calendar life, as the underlying chemistry is the same.

The reality is that a battery pack consisting of hundreds of cells will likely have fewer cycles and a shorter lifetime as the tolerances causes battery pack performance to diverge. An analogy is that a chain of several hundred links is not stronger than the weakest link in the fence.

MYTH #3 - Battery Degradation is Linear

Batteries have a fairly linear degradation in the initial lifetime phase.

However, the internal resistance of the battery increases exponentially as the battery is aging which can lead to dendrites and short-circuits within the cell. This causes more heat, higher degradation, is unsafe to use, and is the main reason why batteries are consistently replaced at 70% or 80% of their “end-of-life” capacity instead of running them to the ground.

This is the main reason why large energy storage companies avoid 2nd life or recycled EV batteries, it is simply too dangerous, unpredictable, and such energy storage projects run serious performance risks. It is much better to simply recycle and have a predictable performance from newly manufactured cells.

MYTH #4 - EV Batteries Perform Well in Grid Storage

EV batteries such as LFP and NCA are designed for minimal cost, weight, size, and have very light actual usage in electric vehicles. Grid storage requires high utilization and reliable long-term operation.

For example, a standard Tesla has an 8-year battery warranty with 70% capacity for 100,000 miles. A full 100% use of the battery is about ~270 miles which means the 100,000 miles is equivalent to ~400 cycles. During these 8 years, this calendar aging and cyclic aging can result in as much as 30% loss of capacity.

Reusing batteries for storage as 2nd-life storage expecting the same battery as what is in the EV to then last 4000 cycles and 10 years is quite remarkable!

Business case of energy storage

The many faces of energy storage.

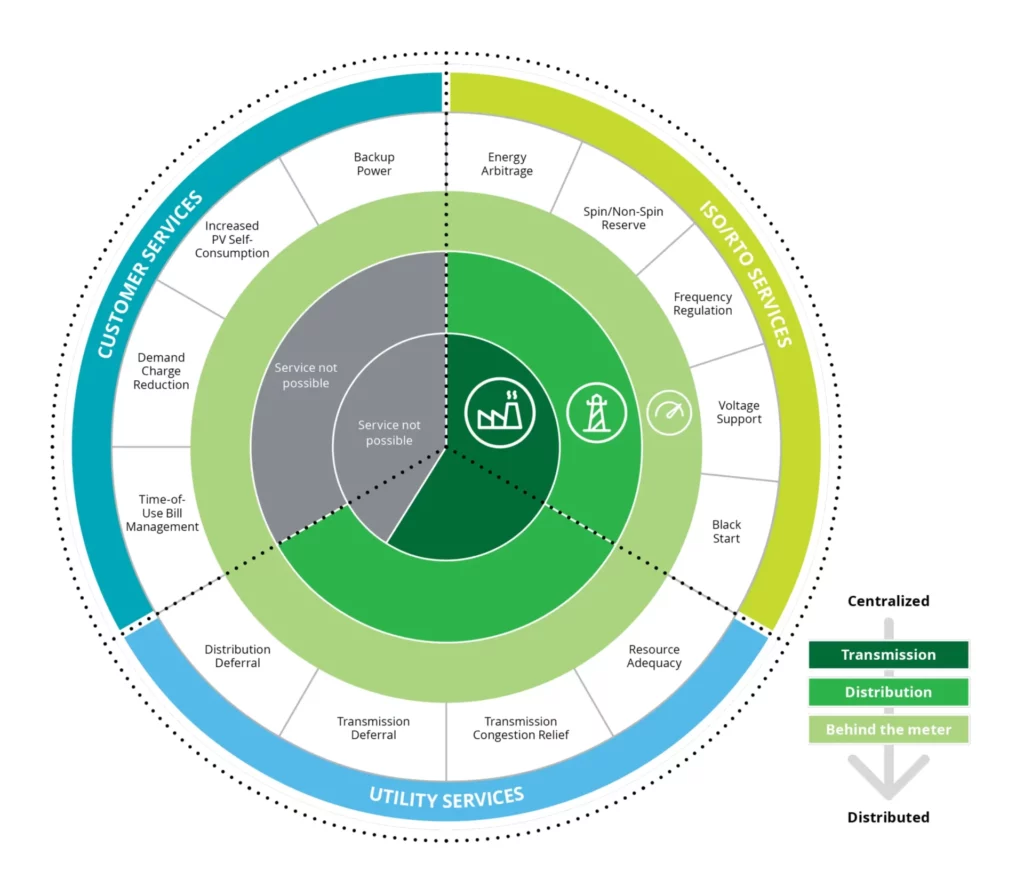

Energy storage is not providing direct energy generation but instead performing a function to perform some beneficial service to the user. A useful analogy of energy storage is to compare it to day-trading. The energy storage system is trying to buy electricity units measured in kWh at the cheapest point (charge) and sell at the most valuable point (discharge). Determining the number of kWh traded and corresponding value has to be simulated and then tracked in reality. Of course, there are more kinds of benefits from energy storage as seen below. For example, having batteries during a black-out might be very valuable but difficult to directly calculate the loss-of-revenue for a business during that blackout. Other services might be performed but are not easily monetized between stakeholders.